Welcome to Insurance Insider's 2020 D&O Rankings survey!

If you are a London market D&O insurance underwriter or broker, we would like you to take part in our survey and tell us who the most highly regarded D&O insurance professionals are.

You will be able to nominate who you think the best underwriters or brokers are as well as the rising stars of the industry.

What is it?

We want you to tell us:

- Who the best underwriters and brokers in your line of business are

- Who the rising stars of this industry are

We will use your responses to produce a ranking of the London market's most highly regarded D&O underwriters and brokers.

All submissions will be treated in the strictest confidence.

Why?

If you take part in the survey, we will let you know the position you achieved in the overall rankings along with what the market thinks about your relative strengths as a professional.

We will also share the feedback left by your supporters with you.

A report containing headline results of the survey will also be shared following the close of the survey.

For more information, please email khilan.shah@insuranceinsider.com

-

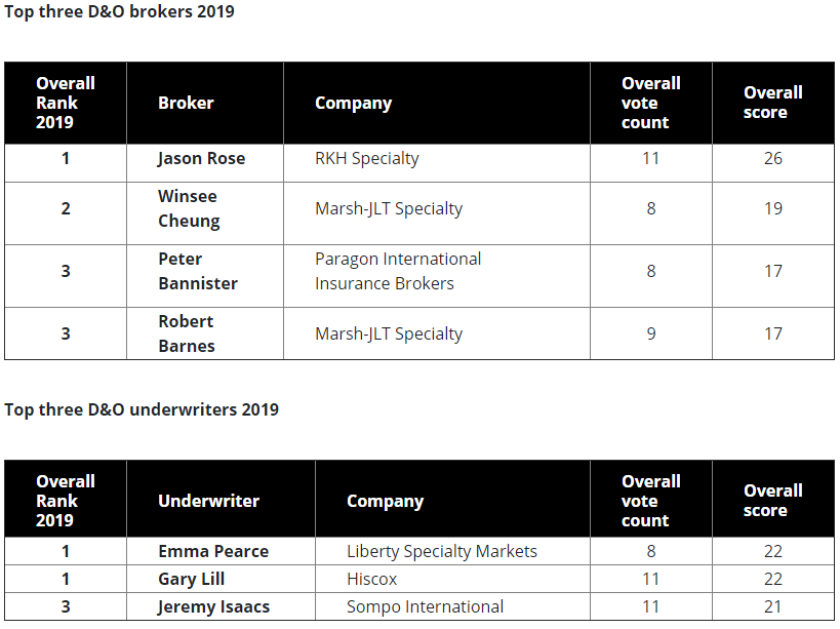

Two professionals win the underwriter rankings and RKH Specialty’s Jason Rose climbs to the top of the broker podium.

-

Gary Lill of Hiscox finishes at the top of the 2018 D&O Rankings

RANKINGS METHODOLOGY

The surveys

The Rankings surveys are two-way surveys by which underwriters nominate the best brokers and brokers nominate the best underwriters. They are typically open for six to eight weeks.

The Insights team has produced a series of rankings across different lines of businesses including Cyber, Political Risk, Political Violence, US Property Cat and D&O

Nominations and scoring

Each respondent is asked to nominate their top three market practitioners. Brokers nominate underwriters and vice versa.

The survey is individual-based so respondents only nominate and score the best professionals, not companies. Individual results, however, are aggregated to also derive company rankings.

Ranking results

The ranking of underwriters and brokers is calculated using a scoring method known as Borda count which assigns 3 points to any respondent’s top choice, 2 points to the second position and 1 point to the third place.

This method provides consistent weighting to each vote while accounting for voters’ order of preference, hence providing the best representation of market preferences. The Borda count is used extensively in other popular ranking awards such as the NBA's Most Valuable Player Award or the Eurovision Song Contest.

Attribute rating and testimonials

Apart from nominating the top three professionals, respondents are asked to mark them on specifically-defined attributes. These qualities define the best underwriting and broking practices and include things such as risk knowledge, effective communication, honesty, analytical skills and creativity.

There are six attributes defining the best underwriting practices and eight attributes defining the best broking practices, against which nominees are rated. Respondents are also invited to provide a statement with their main consideration behind each of their designations.

Response validation and data integrity

Complete confidentiality is offered to all participants, allowing for honest and trustworthy scores and testimonials.

Surveys are mainly conducted online but the data collection process is complemented with phone calls to ensure the required levels of participation. Time and IP tracking is combined with analyst validation of all individual records to ensure data integrity.

Participation and statistical significance

A screened list of potential respondents is used to track and monitor participation rates throughout the length of the survey. Minimum levels of participation are set so as to achieve a maximum error margin of 10% of overall scores at a 95% confidence level.

This means that the final sample size is sufficiently large so as to ensure that ranking scores remain unchallenged if the survey were to be run repeatedly.

This means that if we ran the survey one hundred times, and an individual was ranked 30th, 95 times out of a hundred they would be ranked between 27th and 33rd.

For more information and to gain full access to the survey data please email aura.popa@euromoneyplc.com ormark.lilley@euromoney.com.